Rising fears over an escalating trade conflict sent shockwaves through global financial markets this week, triggering sharp declines across equities, heightened volatility in currencies and bonds, and growing concern over economic stability.

On Wall Street, a key measure of market anxiety — the Cboe Volatility Index (VIX) — soared to its highest closing level in five years, reflecting deep investor unease. The Nasdaq Composite officially entered bear market territory after tumbling more than 10% in just two sessions. Broader indexes like the S&P 500 also suffered steep losses, bringing year-to-date declines close to 14%.

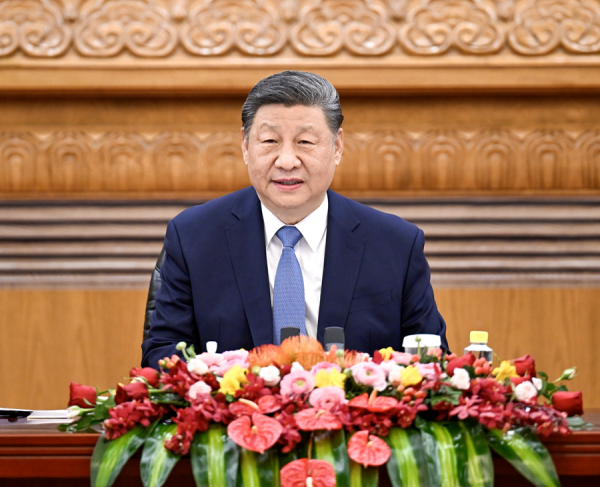

The financial fallout follows sweeping new U.S. tariffs, introduced by President Donald Trump, and swift retaliatory measures from China. The aggressive moves stoked concerns of a prolonged global trade war, pushing investors to seek safety and reassess risks.

“The uncertainty is rattling every corner of the market,” said a senior portfolio manager. “This is more than a typical selloff — this is fear of contagion.”

In the currency markets, the euro experienced its highest one-month implied volatility in two years, while the U.S. dollar swung sharply in reaction to trade headlines. Treasuries rallied as investors flocked to safe assets, pushing the 10-year yield to a six-month low of 3.86%.

Market strategists noted that economic indicators are beginning to reflect the strain. U.S. high-yield corporate bond spreads have widened to levels not seen since late 2023, and credit default swaps on U.S. government debt have surged — signaling rising concern about fiscal stability.

Federal Reserve Chair Jerome Powell acknowledged the potential impact of the tariffs, saying the measures were “larger than anticipated” and could weigh on growth while fueling inflation. Meanwhile, President Trump urged the central bank to cut interest rates, calling it an opportune moment for action.

In equity markets, both institutional and retail investors reacted dramatically. Hedge funds and leveraged ETFs shed over $40 billion in U.S. stocks, according to investment bank data. However, retail investors, hoping to capitalize on the dip, poured nearly $5 billion into equities — marking the highest single-day inflow in a decade.

Still, analysts caution that volatility is unlikely to fade soon. “Unless we see real movement toward negotiation or policy changes, market pressure is likely to persist,” said Kathy Jones, chief fixed income strategist at a major U.S. brokerage.

Indicators of stress are flashing across the board, from swap spreads to correlation indices. Yet for now, financial professionals say the situation remains tense but controlled — a market on edge, but not in full panic.